The bank's FFIEC report and what it means

I'll try to breakdown the report and summarize the things I have noticed

I promised to put out the SBC expenses post next but it is taking longer than I expected due to being busy with work, but the FFIEC report deserved a post.

So the FFIEC report was published while I was asleep and tweets and videos started coming out about how great it is and about profitability. The only thing I will say about this is - Hold up.

SoFi Bank reports are NOT comparable to SoFi’s earnings reports. Almost nothing in there is directly comparable. Loans in the bank are not comparable to loans with SoFi because of warehouse lending, deposits are not comparable for what ever reason (I absolutely have no idea why they are not comparable, I tried asking SoFi IR but IR is just awful), interest income and expenses are not comparable either due to inter-company transactions and a lot of other data is not comparable.

There are things that are comparable and there are things that can be learned from this report even without it being comparable to SoFi.

Let’s start with the most important thing to people

Deposits

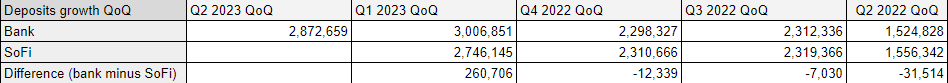

So like I said earlier, deposits are not comparable between the reports. Here is an example using Q1 2023.

So what do we learn from these two? SoFi Bank grew deposits by 3,006,850K.

What about SoFi?

So what do we learn this time? SoFi grew deposits by 2,746,145K.

So not only the deposits numbers don’t match (you can see the difference in the screenshots above) but the deposits growth doesn’t match either.

What is the cause of this? I do not know. Both balance sheets are supposed to be values on the last day of the quarter (the difference could be late deposits or next day deposits but can’t really tell).

We can look at the past reports and realize that there is always a difference between the reports. It has never been as large as from Q4 to Q1 and the bank never had higher growth than SoFi until Q1. Until last quarter I assumed the difference is always insignificant, perhaps rounding or late deposits that could cause it, but with 260mil difference between them in Q1, with that I was caught off guard.

But looking at the table above, what conclusion can be drawn from it? That SoFi’s deposits growth will be lower by 200-300mil again? Then it contradicts the quarters before it. That SoFi’s deposits growth will be higher? Then it contradicts Q1 2023. Personally, I have no idea how SoFi’s own deposits will look. Could it again be 260mil lower? Sure. Could it be very close like quarters before? Also sure. Could it be again higher by a bit? Sure. Could that 260mil be accounted in SoFi’s deposits growth and the deposits will be 3.2B? Yes.

One thing is for sure, it won’t be near the guided 2B of deposits growth, I would likely put the range at 2.6-2.9B but as I said, it could even be 3.2B, this explains just how much these differences are confusing and make little sense.

Provisions

Provisions are actually comparable because only the assets in the bank require provisions.

This table is of YTD values. What we know? SoFi has an allowance balance of 41.23mil (meaning they put aside 41.23mil to cover losses in certain loan types, loans valued at amortized cost). This value is higher than the allowance in the end of Q1, which was $38.9mil. Meaning SoFi expects more losses in their loans than they expected before (which is natural because they also lend out more). In Q1 SoFi had 10.35mil of charge-offs and they provisioned only 8.4mil, meaning they expected needing less allowance for what they held at that time. In this quarter SoFi had 10.5mil charge-offs (20,841-10,345) and they decided to provision even more than the charge-offs. So in Q2 SoFi had 12.6mil of provisions for credit loss (21,022-8,407). Now bare in mind, provisions impact income directly so this quarter SoFi will lose 12.6mil on provisions alone, 4.2mil more than in Q1.

Noninterest expense

It is again not fully comparable but some data and conclusions can be drawn for SoFi’s own earnings.

Few things we can know for sure is that the bank’s employee salaries, expenses on premises, amortization, marketing and provisions will be part of SoFi’s report and numbers as well so we might as well look at them and calculate the difference.

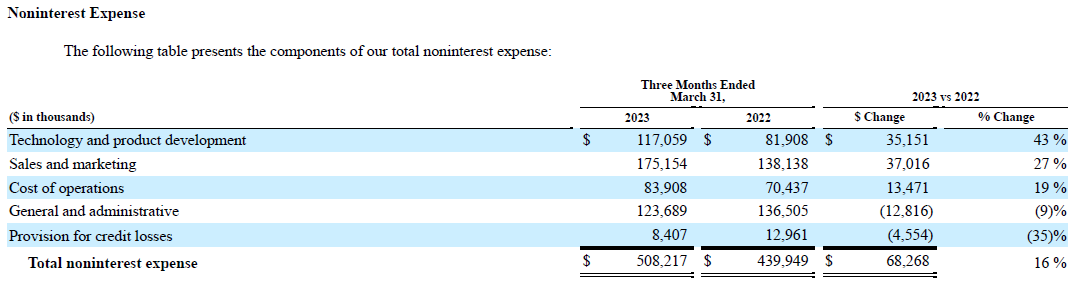

So let’s look at Q1 noninterest expense first:

And we’ll add the partial breakdown for “other noninterest expense”:

What can we see in these two screenshots?

Salaries - 69,292K

Expenses on premises - 3,512K

Amortization - 34K

Other noninterest expense - 179,643K

Advertising and marketing - 117,010K

General and administrative - 43,721K

Total - 160,731K. Difference - 18,912K.

Total - 252,481K

Now how does this correlate to the earnings report?

Let’s start with marketing. The bank had 117mil of marketing expenses in Q1, SoFi as a whole had 175mil of sales and marketing expense. This means that 67% of SoFi’s sales and marketing expense was already noted in the bank’s report, this left 58.1mil of marketing expense for the rest of SoFi.

Let’s look at the next thing, “General and administrative”, also known as G&A. 43.7mil expensed by the bank, but expenses on “premises” are generally part of G&A so we will add that to the number as well and get 47,233K. So here the bank’s G&A is 38.2% and left 76,456K G&A expense to the rest of SoFi.

And of course, we already talked about provision for credit loss which is also part of the noninterest expense.

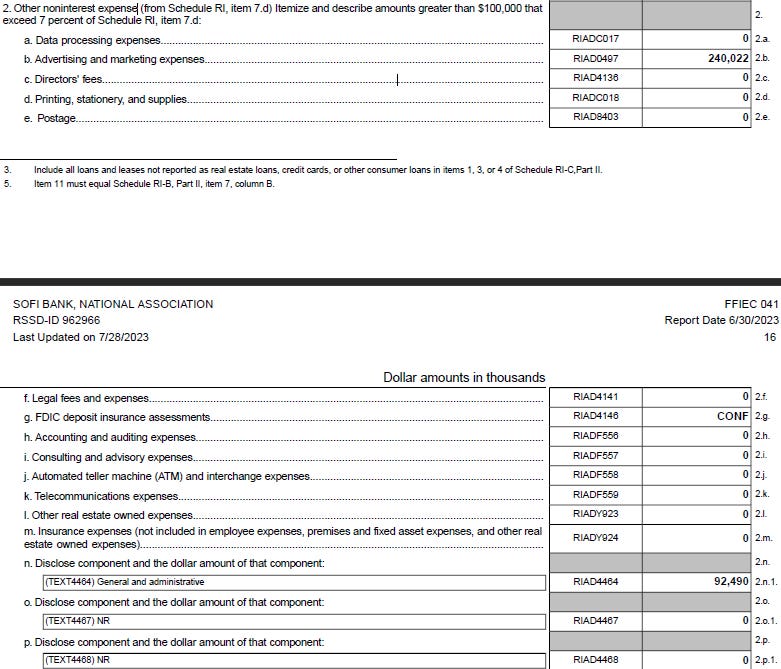

What does this all mean now? In the same way I got to the numbers above, let’s get the numbers from the bank’s Q2 report.

Have to remember, these are YTD so we need to subtract them from the Q1 results:

Salaries - 78,433K

Expenses on premises - 4,078K

Amortization - 1,097K

Other noninterest expense - 193,367K

Advertising and marketing - 123,012K

General and administrative - 48,769K

Total - 171,781K. Difference - 21,586K.

Total - 276,975K

So the bank’s noninterest expense increased in Q2 by 24,494K. What does this mean for SoFi? First of all, let’s look at the breakdowns we did above for SoFi’s numbers.

The bank had 117,010K of advertising and marketing expense in Q1, in Q2 that increased to 123,012K. Assuming the rest of SoFi will remain with flat sales and marketing, that could be a 6mil increase to sales and marketing expense.

Looking at G&A, this also increased from 47,233K (combined with premises) to 52,847K, again an increase of 5.6mil.

Let’s look at provisions, we already know that in Q2 provisions increased from 8,407K to 12,615K. This is yet another increase in expense of 4.2mil.

Now salaries, in Q2 the bank’s salaries came 9,141K higher than in Q1 so that is more expenses.

And amortization, came in 1,063K higher than in Q1.

It is quite possible that the last 2 are due to the acquisition of Wyndham Capital Mortgages.

To summarize the increase in expenses calculated here:

6mil + 5.6mil + 4.2mil + 9.14mil + 1.06mil = 26mil.

So to end up with the same exact net loss as in Q1, SoFi will need at least 26mil higher adj. net revenue (total net revenue less servicing value plus residual interest).

In Q1 SoFi came in with 460.2mil in adj. net revenue, they will need at least 486.1mil to have the same net loss as in Q1.

Guidance and thoughts

Management’s guidance was 475mil (470-480) in Adjusted net revenue.

SoFi could of course cut expenses on other things in order to make the cut or have other parts of the business add the required revenue (PFOF as one example, BNPL merchant fees as another example).

This quarter it will be interesting to see the results of the other segments and revenues outside of the bank because the bank’s revenue is barely higher this quarter than the previous quarter. NII (Net Interest Income, which includes intercompany transactions) in Q1 was 184,018K, in Q2 it was 247,691K, so in Q2 NII was higher by 63,673K. But noninterest income in Q1 was 174,258K while Q2 was 127,291K, which means 46,967K lower, combined the total is 16,706K higher.

But due to noninterest expense (that we talked about earlier) being lower by 24,494K, and provisions being higher, the bank ends up with lower net income (85,392K before taxes vs 100,744K and 63,070K after taxes vs 72,977K).

Final thoughts

Unlike the Q1 bank report, which was amazing, this one isn’t that amazing, in my opinion. SoFi will probably beat the average adj. revenue estimate (478.59mil at the time of writing) but they will need quite a bit higher than that to have smaller net loss. This is all assuming SoFi’s noninterest expenses outside the bank remain the same as in Q1, if SoFi lowered their other expenses then it would be easier to beat (EPS will probably beat average also, but doubtful SoFi will breakeven this quarter to beat the highest estimate). Last quarter SoFi beat the guidance of 435mil adj. net revenue and hit 460mil, beating by 25mil so it isn’t that farfetched that they beat their guidance by just as much as needed to make net loss lower. That being said, in June SoFi had a bunch of new SBC batches kicking in (as well as RSUs for directors at the annual meeting) so it is very possible SBC expense picks up this quarter (Noto also had an RSU batch finish in Q1 and Lapointe had one finish in Q2).

Disclaimer:

I have a position in SoFi and all that.

Do your own due diligence, anyone can be wrong, I just try to provide information with as much sources so that people reading can draw their own conclusions.

As always, feel free to comment if you do not agree or didn’t understand something and want clarification.

Thank you very much for this. I was wondering what your view would be. It would be nice if the. FFIEC report would line up with SEC reports. I noticed the FFIEC is subject to a number of updates, spelled out in their Q&A. I wish your take was a bit rosier.