SoFi Q1 2024 risk changes plus some extra

Just the usual risk changes QoQ but also some more interesting things I stumbled on

Sorry it took so long to get this out, I tend to procrastinate but also was busy with work.

So I went over the risk changes and there weren’t that many changes in this quarter.

Similar to the past posts, in this one I will also skip some of the changes as they are general additions like the middle east or the US elections. Like in the past, Q4 risks will be displayed on the left side while Q1 will be displayed on the right side.

I will first start with the non-risk changes.

Non-risk changes

Members

So at this point everyone, or most, might already be aware that SoFi made some changes in Q1 to how they count members.

This is a footnote SoFi gave in their presentation:

Beginning in the first quarter of 2024, new member and new product addition metrics for the relevant period reflect actual growth or declines in members and products that occurred in that period whereas the total number of members and products reflects not only the growth or decline of each metric in the current period but also additions or deletions due to prior period factors, if any, described in footnotes 1 and 2 above.

Basically “New Members” is no longer the difference between the quarters but rather the net member growth during the quarter, while “Members” will also include adjustments done to previous quarters as well.

There are few explanations why there is a divergence -

Crypto being fully removed in Q1 (some removed in Q4 but some remained still).

SoFi published a new fee schedule for SoFi Invest, which included inactivity fee that was changed from 12 month inactivity to 6 month inactivity. This could have caused more account closures if they had completely inactive accounts. The more inactive accounts close the better imo.

The last point was disclosed in the earnings report and it states the following:

Beginning in the first quarter of 2024, we aligned our methodology for calculating member and product metrics with our member and product definitions to include co-borrowers, co-signers, and joint- and co-account holders, as applicable. Quarterly amounts for prior periods were determined to be immaterial and were not recast.

Basically SoFi will be including co-borrowers, co-signers, joint-account holders and co-account holders as additional members. (co-borrowers and co-signers will not be counted as additional loan products, joint and co-account holders will be counted as additional FS products though).

Industry Trends

SoFi has removed that entire first paragraph. I think it could be taken as bullish, because they don’t see issues in the macro ahead that could lead to economic downturn.

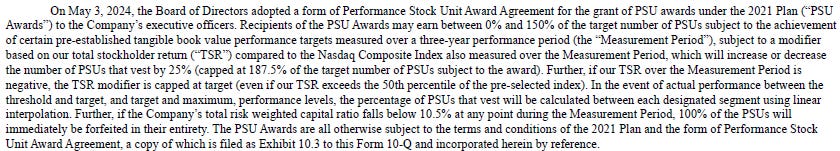

PSUs

If you’ve read my previous post, that discussed some of the data from the annual meeting, you would know that Noto was granted PSUs that are tied to SoFi’s TBV growth over the next 3 years (plus some other extra terms that I already mentioned).

Well, on May 3rd the board, according to the earnings report, awarded PSUs with the same terms to more execs.

Convertible notes

It is of no surprise that the convertible notes appear in the report since the transactions took place during the quarter.

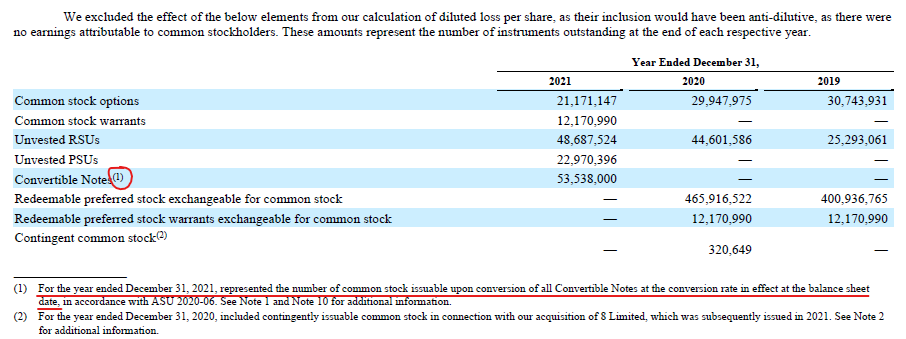

I want to first share a bit from the Q4 2021 earnings report relating to the 2026 convertible notes that were issued during that quarter.

You can see that SoFi discloses that these are the amount of shares that will be issuable upon conversion of the notes.

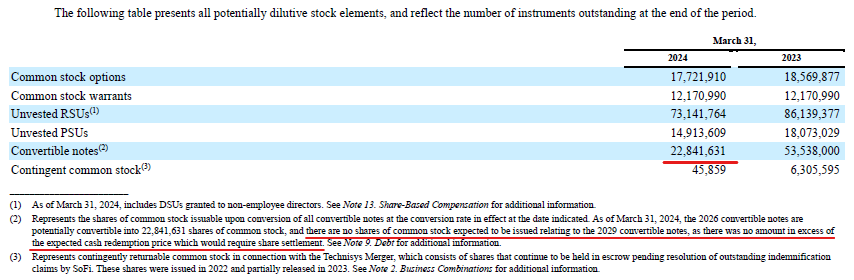

Now let us look at this quarter’s table.

Do you see any difference? SoFi expects that the 2029 convertible notes will have no impact on the common stock share count. This wording was never used on the 2026 notes, at least in the reports I looked. This would also mean that the 2029 notes have no dilutive impact on diluted EPS.

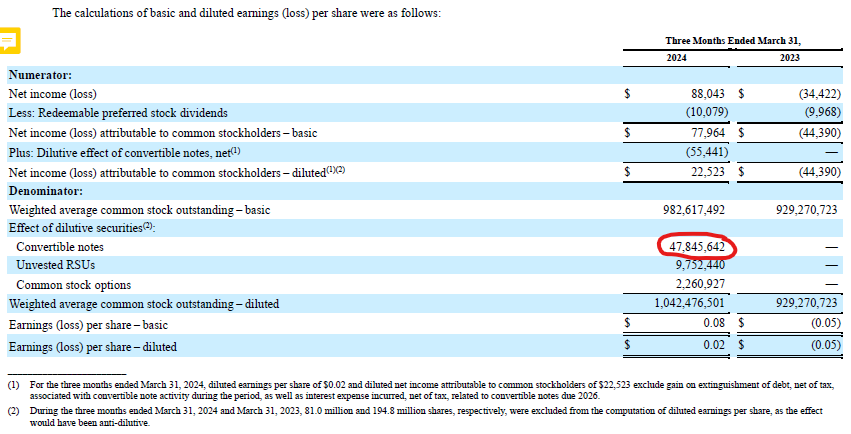

An important thing to note as well. Diluted EPS is calculated using weighted average outstanding shares. Meaning the convertible notes transactions would have a small impact on the numbers, as can be viewed in the 10Q:

Notice that the shares relating to the convertible notes have a different amount from the table before that? 25mil shares difference to be exact. This would indicate that in Q2 the shares relating to the convertible notes would drop by 25mil. But hold your horses before thinking EPS would be a blowout in Q2, remember that SoFi issued shares to buy back the 2026 notes, and a lot more of it so it would have negative impact on diluted share count. But it would bring diluted share count closer to basic share count and as such, potentially, diluted EPS closer to basic EPS.

Summary Risk Factors

There were no changes in the summary of the risk factors.

Business, Financial and Operational Risks

We operate in rapidly evolving industries, and have limited experience in parts of our Financial Services and Technology Platform segments, which may make it difficult for us to successfully identify and address the risks and uncertainties we face.

As you can see, SoFi added 2 new operations offered.

Following the above, they also made some adjustment in relation to Wyndham.

It appears that the Wyndham tech and employees are fully integrated now and now they are working on developing that tech further.

Our future growth depends significantly on our branding and marketing efforts, and if our marketing efforts are not successful or we receive negative publicity, our business and results of operations will be harmed.

SoFi added the above to the marketing risk. I don’t like it when rules or regulations use the words “reasonable” or “unreasonable” because then it is open to interpretation. SoFi might decide something isn’t an “unreasonable advantage”, and end up getting a fine because regulators decide that it is.

The conditional conversion feature of the notes, if triggered, may adversely affect our financial condition.

It makes sense seeing as they issued the 2029 notes this quarter so there isn’t much to say about this.

Market and Interest Rate Risks

Our business and results of operations have in the past and may in the future be adversely affected by the financial markets, fiscal, monetary, and regulatory policies, and economic conditions generally.

Added the possibility and variability of rate cuts. I suspect that in Q2 they might remove the “whether it will continue to raise rates further” after Powell indicated that there won’t be more rate hikes.

Changing expectations for inflation and deflation and corresponding fluctuations in interest rates could decrease demand for our lending products and negatively affect loan performance, as well as increase certain operating costs, such as employee compensation.

SoFi only added the “continued” to this risk. SoFi already had the risk pointing out the uncertainty of growth in the US economy, now they clarified that it is “continued growth”. They are still worried about macro and the possibility of some sort of recession, or at least 1 negative GDP print.

Strategic and New Product Risks

Demand for our products may decline if we do not continue to innovate or respond to evolving technological or other changes.

SoFi again (similar to Q4) adds sentences relating to regulation on AI.

Credit Market Related Risks

We service all of the personal loans we originate and credit cards we issue and have limited servicing experience, and we rely on third-party service providers to service the student loans and home loans we originate, and to perform various other functions in connection with the origination and servicing of certain of our loans. If we or a third-party service provider fails to properly perform these functions, our business and our ability to service our loans may be adversely affected.

SoFi added risk from third party service provider failing in relation to loans.

Funding and Liquidity Risks

Any failure to accurately capture credit risk or to execute our funding strategy for SoFi Credit Card could have a negative impact on our business, operating results and financial condition.

Well, the proposed restrictions on credit card fees apparently were finalized and should have become effective since we are in May1, but I guess it could be challenged in court.

Regulatory, Tax and Other Legal Risks

Legislative and regulatory policies and related actions have had and could in the future have a material adverse effect on our student loan portfolios and our student loan origination volume.

More student loan relief programs.

If we fail to comply with federal and state consumer protection laws, rules, regulations and guidance, our business could be adversely affected.

This was already mentioned before in the “Business, Financial and Operational Risks” section.

We hold state licenses that result in substantial compliance costs, and our business would be adversely affected if our licenses are impaired as a result of noncompliance with those requirements.

SoFi also added “brokers” to the services SoFi Lending Corp. provides. I believe it is likely related to Lending-as-a-Service that SoFi offers by forwarding applicants to the likes of Pagaya, Upstart and others. I am not sure it is for Lantern though, otherwise maybe it would have appeared there long ago.

We may become subject to enforcement actions or litigation as a result of our failure to comply with laws and regulations, even though noncompliance was inadvertent or unintentional.

This has been mentioned before in this post and also in the Q4 risk changes post.

Changes in applicable laws and regulations, as well as changes in government enforcement policies and priorities, may negatively impact the management of our business, results of operations, ability to offer certain products or the terms and conditions upon which they are offered, and ability to compete.

This appears as if a lot was changed but in reality not as much. You will notice there is a lighter orange color background in this risk. Because SoFi moved the bottom portion (“See also “Lawmakers,..”) below the “On October 13, 2023” portion, it considers it as changed sections, or at least removed from their positions.

The only thing that was added here was the orange section (“On February 22, 2024”). The SEC basically amended a rule2 that requires more things from SoFi.

Our investment adviser and broker-dealer subsidiaries are subject to regulation by the SEC and FINRA.

The definition of who is an investment advice giver has apparently been expanded to retirement accounts.3

We recently transferred our digital assets-related trading services to comply with regulations governing bank holding companies; this transfer could adversely impact our member relationships and our reputation.

SoFi keeps tracking additional lawsuits filed against Crypto brokers. Not a change this quarter but they do note that they could face some action if regulators determine so even about past business.

Personnel and Business Continuity Risks

There were no changes in the personnel and business continuity risks.

Risk Management and Financial Reporting Risks

We may fail to meet our publicly announced guidance or other expectations about our business and future operating results, which could cause our stock price to decline.

A change from “from time to time” to “typically” likely doesn’t mean a lot. But that isn’t the most interesting part. SoFi basically says in the other change that they might randomly announce guidance outside of an earnings call and an earnings release. Perhaps guidance adjustments if macro is much better than expected? Perhaps just giving themselves the option to adjust guidance when needed, including for negative things.

Information Technology and Data Risks

The collection, processing, use, storage, sharing and transmission of personal data could give rise to liabilities as a result of federal, state and international laws and regulations, as well as our failure to adhere to the privacy and data security practices that we articulate to our members.

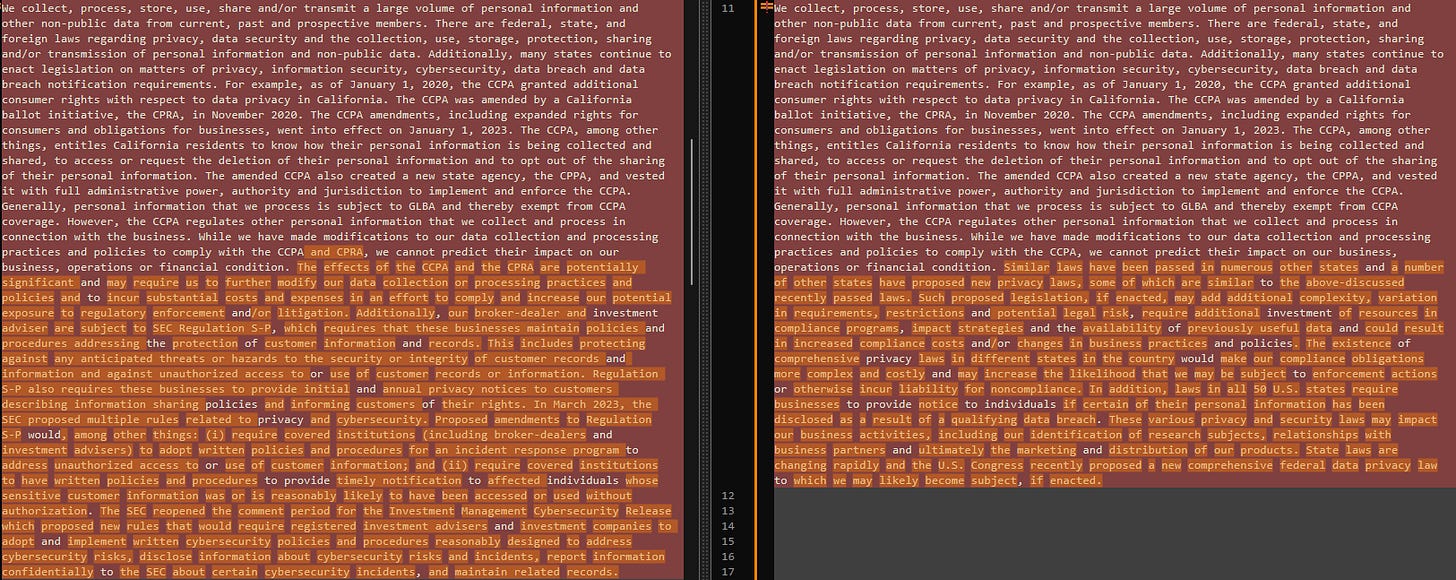

So, this looks like a lot was changed in this paragraph but in reality it is mostly just SoFi shortening it to indicate that different states have different regulations in terms of privacy which makes it more difficult to not “mess up”.

SoFi also removed a mention of a proposed amendment to “Regulation S-P”. This amendment actually passed on May 16th.4

SoFi also removed a mention about the SEC reopening the comment period of the “Investment Management Cybersecurity Release”. I tried finding information about this but couldn’t. Perhaps it is the same one that was approved on May 16th, perhaps they were combined or perhaps it didn’t pass yet but it is of less significance. The most important part is knowing SoFi keeps track of all the regulation proposals and know what they need to do to adjust.

Risks Related to Ownership of Our Securities

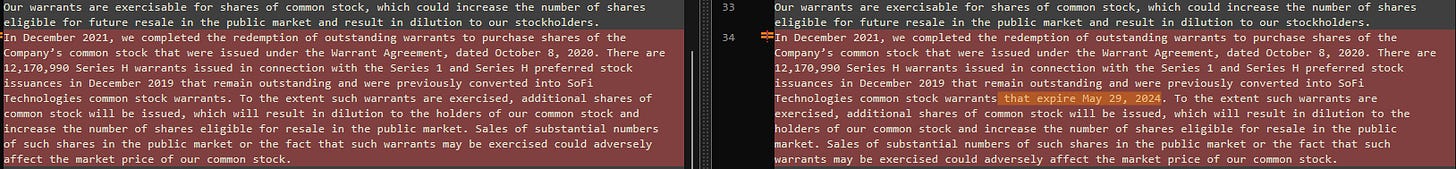

Our warrants are exercisable for shares of common stock, which could increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders.

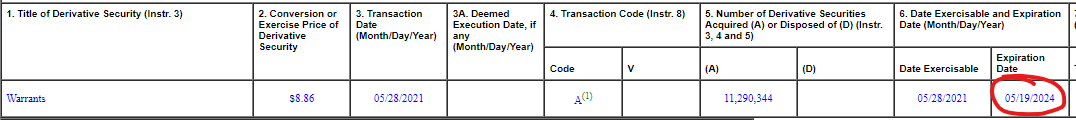

I’ve mentioned this before in different places but here SoFi also notes that they have warrants that expire on May 29th. While they do disclose that they have warrants that expire on May 29th, most of them actually expire on May 19th.

You can find the form 4 above here. I do not know why most of the warrants (specifically the ones relating to QIA) expire on May 19th while the rest expire on May 29th. Perhaps it is a mistake in the filing or perhaps SoFi forgot to mention it in the risk above that some expire on May 19th too.

One final thing that is related to the warrants above but is not related to risks. I want to correct something I said in different places (whether Reddit or Twitter). I said that QIA will lose their board seat after SoFi redeems the preferred shares that they have, because other than the preferred shares and the warrants they don’t have any shares of SoFi (shares written in the name of their director do belong to them but those are only 60k).

That was actually wrong and somehow I missed quite a lot of shares that they hold. If you check the form 4 that I shared above you will notice QIA had 24.53mil shares in May of 2021, in November they sold 4.69mil of those shares, leaving them with 19.84mil shares. They didn’t file any other SoFi related filings so it is fair to assume that they still hold those 19.84mil + the 61k shares that are under the name of their director (they own those shares too).

Because of this, they still satisfy their requirement for the board seat, and as such won’t lose it by not buying more shares before the preferred shares redemption date.

Disclaimer:

I have a position in SoFi and this isn’t a financial advice and all that. Remember to always do your own due diligence, I can be wrong just as much as everyone else on the internet can be wrong. Doing your own research is important.

Thanks again for your work. What I find most intriguing, is the possibility of random announcements of guidance changes outside of normal earnings calls and releases. Those who take positions right before earnings, hoping to unload them right after earnings, or some such scenarios, may find themselves on the sidelines if something of positive merit appears in the interim. I can see how this might reduce some of the earnings pop and drops that have become standard practice.

Thanks Vadim. Change in incentive structure is a good find. For me, member growth is the single most key factor as they are now able to monetize each member at around 12 month mark. Would love your thoughts on it