I figured I’ll use this weekend to write what I’ll be paying attention to in SoFi’s 4Q/FY 2023 10K on Monday.

So what will I be keeping an eye on in SoFi’s 2023 10K report?

Worth pointing out, some of these will not be known until the report drops, which will likely be a week or so after the earnings call (based on past experience). These are also not everything I will be looking at but these are the most important to me.

Credit Card Performance

So there are few things to understand about SoFi’s CC. SoFi’s own CC is not the only CC that SoFi has.

SoFi finalized the acquisition of GPB (Golden Pacific Bank) back in January 2022. GPB was a fully fledged bank already for many years (December 1986 is when the bank was established, under the name Foothill Community Bank). So the bank already had debit cards, credit cards, checking and savings accounts, business accounts, business loans etc. My point is, there are clients who use SoFi Bank, who are not members of SoFi. These clients would have CCs, business loans, checking and savings accounts etc. Based on past reports, the bank had 0 in CC loans though, and used Elan Financial Services for the CC, Galileo probably replaced it for them after a certain amount of time (this all points me to the belief that the CC debt used to be financed for GPB by a different bank, or some 3rd party partner).

We know that the bank reports an FFIEC report every quarter, below is a breakdown related to the CC:

The most important line is probably the net charge off rate. What can we learn from it? For one, charge offs are fairly high (compared to SoFi’s loans, and it is not surprising). But we can see a downward trend in the net charge off rate starting from Q1 2023. We know SoFi aims to launch more CC types so we can only assume they will continue ramping up CC debt so hopefully they find the formula to control it.

I will be looking to see whether this downward trend continues, but I am not confident that it will. If you look at Q4 2022, you will notice a spike in charge-offs. The next table will have more indication to support a possible increase in rate.

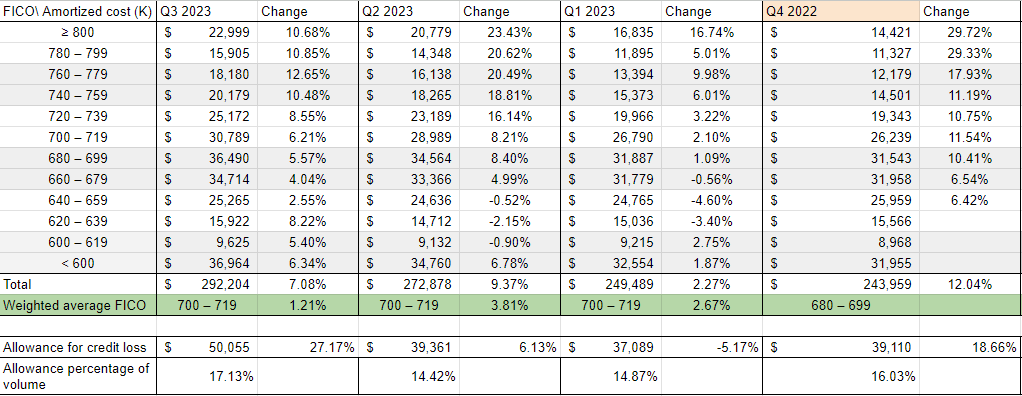

In Q1 2023 SoFi decided to add “<600” and “600-619” to the mix, probably because they felt more comfortable with lower FICO using the CC, as well as them not having many choices due to CRA (Community Reinvestment Act) compliance requirements (If you look at the “Q4 2021” column you will notice SoFi had no CC debt with those).

Earlier I said this table adds more indication towards this quarter having higher charge offs. Where can we see it? We can see it in Q3 2022. In Q3 2022 SoFi bumped their allowance percentage and in Q4 2022 we can see (the table before) a spike in charge offs. In Q3 2023 we see a similar bump in allowance percentage. This combined with holiday shopping makes me believe there will be CC charge off increases in Q4 and probably Q1 too. I also hope to see further imporovement in the weighted average FICO of the CC debt, but also remember that higher FICO borrowers can consolidate that debt into a PL.

Student Loan Sales

I do not have a number of how much student loan volume I want to see sold, but I do expect to see sold student loans. Why? Because I do not see it as a better “hold” than personal loans and I believe SoFi will continue ramping up credit cards (capital is shared between all of them so more held student loans means less personal loans or credit card debt).

I do expect SoFi to originate more student loans in Q4 than in Q3. I expect something between Q4 2021 and Q1 2022 in originations, perhaps $1.3-1.4B. Just to give you a taste of why I do not see SLs as a good hold and expect them to sell loans:

SoFi refinanced that SL at 3.99% (January 26th), their APY is 4.6% while warehouse facility weighted average rate was at 6.31% in Q3 (SL warehouse facilities specifically was at 5.86% – 7.16%). See my discomfort with holding those? SoFi’s funds cost more than the return from holding this loan. This is before also taking into account a possibility of default, regardless if it is extremely low (0.5% estimated annual default rate for SL). This loan should be sold to a buyer that has low cost of funding and need low default chance loans.

Personal loans defaults and delinquencies

Personal loans have always been a painful point on SoFi’s balance sheet in back and forth arguements between bulls and bears. On one hand, it is doing fairly good performance wise (some will say that they have yet to season which is the reason) and on the other, they are unsecured riskier loans.

This is why there is a need to keep track of their performance, especially with no allowance for credit loss. With the expected slowing of lending, an increase in both charge-offs and estimated annual default rates is expected. When Fitch rated SoFi’s Q1 2023 securitization1 their base case was 5% default rate.

An important point in the table above. In 2022 SoFi measured the quarterly average unpaid principal at a 4 month average (end of month values), while in 2023 SoFi moved to measure it daily.

Another point, SoFi discloses mostly full year numbers in 10Ks, meaning I had to calculate the weighted average volume in Q4 2022, it could be wrong if I messed up the math but I don’t think so and the numbers seem to fit in the net charge off rate too.

What we are seeing in the charge offs is increases as loans season. SoFi’s annual default rate estimate for fair values is 4.6%, meaning it is still well below what SoFi is already estimating. I do expect it to increase in Q4 as loans continue to season.

Risks

I do not have anything that significant to say about risks. I will keep an eye on whether new things are added there and will also share the changes in a post, similar to the last quarter.

Technology Platform Results

This is likely the most talked about topic in the recent weeks.

In January 2023 Dave has extended their agreement with Galileo for 5 more years, with the possibility of 1 year extensions unless either side gives a written notice on non-renewal (meaning Dave will be using Galileo at least until January 2028).

I would love SoFi to announce things like this when they discuss the tech platform. I only found out about it because I can Google very well and found it in Dave’s 2022 10K.

What I expect from the tech platform, in terms of results is 9mil intercompany revenues (due to SoFi’s own growing member base) and 95mil in revenues. In terms of accounts, I expect 145mil (~9mil new).

SoFi has been in RFPs for a while, Noto has mentioned onboarding a component of a regional bank and also see it gradually increase over the next 18-24 months. They also probably signed new clients as well. So it is about a similar slower growth that Galileo had in the last 2 years due to macro but shows signs of improvement.

I expect the tech to eventually return to about 18-20% of revenue/adj. revenue but not this quarter. SoFi guided this quarter to a mid point of ~569mil in adj. revenue, if we assume they hit exactly that then tech will be ~16.7% of adj.revenue (higher revenue would put tech at a lower percentage). Seeing as higher revenue results are expected, I also expect lower percentage as I don’t think tech can do too much higher than what I currently expect.

Extra things

Listen to see if management talks about the servicing deal they did with JPM and see if they have any future plans to expand into offering servicing to other lenders. It could be a possible capital light revenue stream and a new customer acquistion channel. For now it appears that SoFi created something called “SoFi Servicing Account”2 for the servicing, and it appears that it is through LoanPro (but that doesn’t appear to be ready yet).

Also expecting to hear an announcement about altentative investments date. Cathie Wood already more or less announcd that her VC fund will be available on SoFi alternative investments in January, but January is already practically over and we also know this product is in beta testing right now, so there is some delay from what she was told.

I am sure there are many other things people will want to keep an eye on but these are the ones I will be, some of them I have been keeping an eye on for quite a few quarters now.

Disclaimer:

I have a position in SoFi and this isn’t a financial advice and all that. Remember to always do your own due diligence, I can be wrong and everyone else on the internet can be wrong. Doing your own research is important.

Thank you Vadim!

Awesome article. Ty for the framework.