I am just using Substack because it saves drafts easier, unlike Reddit which removes pictures from drafts.

About me: I am a Software Engineer who likes learning and digging into financials and doing research into companies when they interest me.

Some of my posts about SoFi on Reddit:

To be honest, up to this point I never bothered considering what multiples SoFi should have and personally it doesn't really matter to me because of the duration I plan to be invested in SoFi for. If tomorrow it runs to $10 or $15, I might sell couple of insignificant shares but absolutely not something material like I trim in other companies I am invested in.

But after a discussion with IP Banking Research about SoFi’s multiples on Twitter I started looking into peer valuations just for my own curiosity. This is pretty much my thought process while doing exactly that.

So first let's understand how should we define SoFi. SoFi's business in general is divided into 2 parts. The first part, what everyone online already sees, the online banking. The second part is something that people who don't research SoFi don't even know about, the tech platform.

Let's consider what the online banking consists of. It consists of personal banking and lending. So we need to compare that part to other companies that do personal banking and lending, specifically focused on unsecured lenders because of the large focus on personal loans (and student loans too).

Who are the peers in this? The peers are the likes of Discover and LendingClub. I don't want to compare to the likes of Upstart because that is just tech, even if they are holding some loans these days. I would add online banks like Ally and Capital One to the mix, because they also share a very large portion of the business with SoFi but eventually I decided not to because of the exposure to auto loans in the current macro and other business segments that they have.

So what are the values we should consider for the online banking to have it comparable to SoFi? First of all, trailing 12 month revenue, then we also need to look at tangible book value (TBV), because that is also how banks are generally valued (banks typically have low Goodwill and Intangible assets, <2% of assets, so Book Value for them isn't that different) and because SoFi has a much higher percentage of Goodwill and Intangible assets than what banks usually have.

So Discover's P/S is - Market cap divided by TTM revenue = 2.01. In the same way, LC's P/S is 0.88.

Now, few background points that need to be taken under consideration. Discover's revenue is going up QoQ:

While LC is actually going the opposite direction and their revenues are declining:

So if we take that into account and give less weight to LC's low P/S, like instead of 50% weight for each, it will be 20% for LC and 80% for Discover. This will bring us to 1.784 P/S. Now looking at this, we have another thing to take into account, Discover is growing very slow compared to SoFi so there should be a premium for SoFi here. I will go with 25% premium, so it would come up as 2.23 P/S, others might argue more or less based on people's preference.

At the same time we can also look at Price to Tangible Book Value (PTBV) before moving to SoFi. Discover's PTBV is market cap divided by tangible book value = 2.19. For LC it will be 0.91. Using the same weighting as before, we will come up with 1.934 PTBV. As opposed to before, I won't add a premium to PTBV because SoFi's TBV is somewhat flat with about 3% growth YoY.

Now that we have this, let's compare it to SoFi. We obviously can't compare it straight up because SoFi has the tech platform that the other two don't so let's subtract the tech platform's revenues (excluding revenues from internal payments) from SoFi's TTM revenues. The tech platform's TTM revenues less intercompany fees comes at 321.64mil. Subtracting that from SoFi's TTM revenues would bring SoFi to 1.393B TTM revenue.

Now if we use the P/S ratio on this, we will know how much contribution to market cap the company will get from the banking part. So what we do is multiply the TTM revenue by P/S ratio to get the market cap, that would add - 3.106B.

While we are at it, let's calculate the MC addition using the PTBV. So we take TBV and multiply it by PTBV, this will give us 6.171B of MC added.

So now we have 2 ratios for the banking portion of the business.

Let us now look at the tech platform.

Who are the competitors? Well, most know Marqeta of course as the competitor for Galileo. But the tech platform added another arm last year, one for banking core so Marqeta alone can't really be used as a peer for the tech platform. Lucky I knew a few others that can fit the slot. Both FIS and Temenos are players in the BaaS market and provide bank cores. Temenos is publicly traded in Switzerland while FIS (Fidelity National Information Services) is traded on the NYSE.

Seeing as neither Marqeta nor Technisys are profitable, we'll use P/S to evaluate this portion of the business. We won't use tangible book value in this case because it is not a metric used for tech companies because of their large Goodwill and Intangible Assets.

So what are their P/S ratios?

Marqeta - 2.96 P/S

FIS - 2.24 P/S

Temenos - 5.94 P/S

Let us look at SoFi now.

SoFi's tech platform is broken into 2 companies, Galileo and Technisys.

I already calculated before the TTM of the tech platform, so now we need to figure out what the responsibility of each. Luckily, SoFi discloses some information that can help.

Let’s try to find the split.

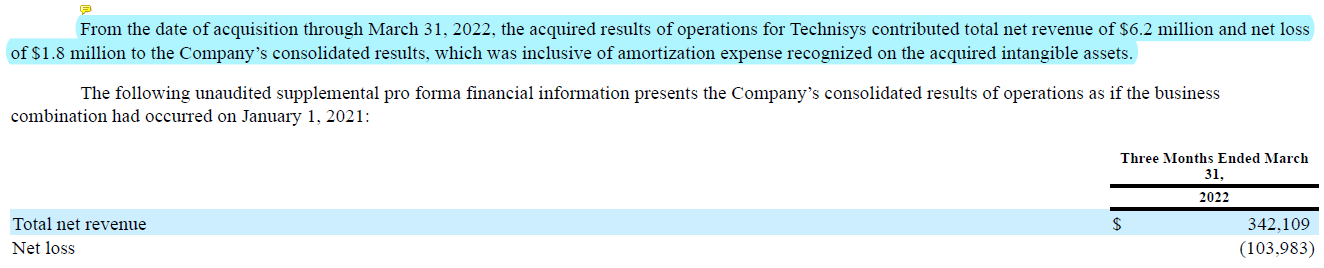

From this quote and SoFi’s pro forma Q1 2022 results we understand that Technisys contributed 6.2mil revenue in Q1 between the acquisition date and the end of Q1.

So what does this mean? It means that we can subtract 6.2mil from Q1 2022 revenue ($330,344k) to get to the revenue excluding Technisys. That puts us at 324.14mil total revenue less Technisys’s revenue. Now from this number and the results SoFi gave above, we can reach the conclusion that Technisys has made 17.97mil in Q1 2022.

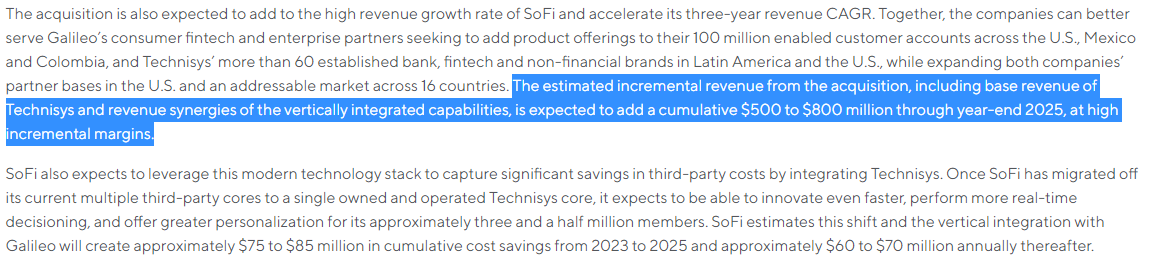

Now this revenue amount is interesting. Why is it interesting? Because of the next screenshot.

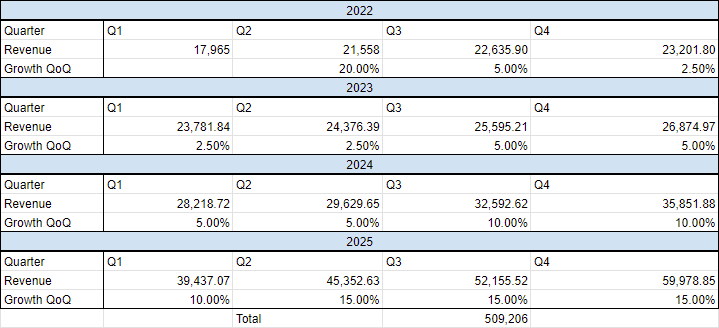

This is what SoFi assumed the cumulative revenue addition from Technisys will be. Important to remember, that was back in Q1 2022, a lot of hikes happened since then and tech slowed expansion investments. If we assume flat 5% growth QoQ for the 15 quarters (Q2 2022 to the end of 2025) we will come up with 425mil cumulative revenue (excluding possible “revenue synergies of the vertically integrated capabilities”). But I don’t think this is case. The reason for this is macro. 2022 would have marked slowing of investments in expansion by companies. The way I think about it is like this: Q2 2022 would still have “high” growth (20%), then in Q3 as companies begin to realize the hikes will be painful that growth would drop to 5% and then in Q4 and Q1 2023 growth will drop to 2.5% QoQ. After that I assume it will pick up again in Q3 2023 to 5% and then pick up to 10% in Q3 2024 and then to 15% in Q2 2025. This will finish 2025 with cumulative 509mil revenue.

Where does that leave us? That leaves us at 91.18mil coming from Technisys in TTM revenue in Q1 2023. And that leaves us with the remainder of 230.46mil for Galileo TTM revenue.

So now what?

Now we make more assumptions. Both FIS and Temenos are large. Their growth YoY is small (FIS grew 8% YoY, Temenos grew 13% YoY) compared to Technisys (in my estimates, 32.4% YoY growth).

So if we take the average of both of their, P/S 4.09, and add a premium of 20% again, we will get 4.908 P/S. Where does that leave us in terms of MC? This would leave us at 91.18mil x4.908 and we get 447.51mil MC.

On to Galileo. I will use the same P/S Marqeta has because they offer very similar things. Ideally, if you want you can add a premium to Galileo due to the risk in Marqeta having 70% of their revenue coming from a single client or lower P/S because Marqeta is expanding worldwide better while Galileo is focused a lot in LATAM.

So the P/S we will get is 2.96. Using that and Galileo’s 230.46mil TTM revenue, we will get a MC of 686.16mil.

So the combined addition to MC from the tech platform will be 1,129,671,600. But, I believe there should be an extra premium for the combined tech platform of the two of them, I add another premium of 5% to this MC which would put us at 1,186,155,180.

So where are we now?

Tech platform P/S MC - 1.186B.

Banking P/S MC - 3.106B.

Banking PTBV MC - 6.171B.

So if you want to value SoFi as a whole on P/S, you would get a MC of 4.292B, or $4.56 share price.

The only issue with this is that banks aren’t valued based on P/S, generally unprofitable companies are valued based on it (while profitable are valued based on P/E). I lean more towards how banks are valued in general and that is PTBV, so combined SoFi as a whole would be 7,357,549,180, or $7.82 share price.

One thing to understand about valuations, there are a lot of assumptions in them. You might see that even though I added premium to some of SoFi’s ratios, they were still lower than some peers even though it is growing faster. The more peers you use more “accurate” your estimate will be, but be careful not to add too many “peers” because you might add companies that aren’t really peers like UPST.

You can also use forward P/S instead of TTM P/S but then you add another layer of estimates on top.

Disclaimer:

I have a position in SoFi, my outlook, premium assumptions, Technisys revenue assumptions could be wrong.

Make sure to do your own due diligence and use premiums and assumptions you might feel more comfortable with.

This post was basically just me and my thought process when evaluating SoFi while also giving some extra information, I didn’t calculate the values prior to writing this post and got the peer numbers also while writing so the end of this post is the first time I saw the result.

If you spot any mistakes or you disagree, feel free to counter.

Amazing, thank you for sharing.